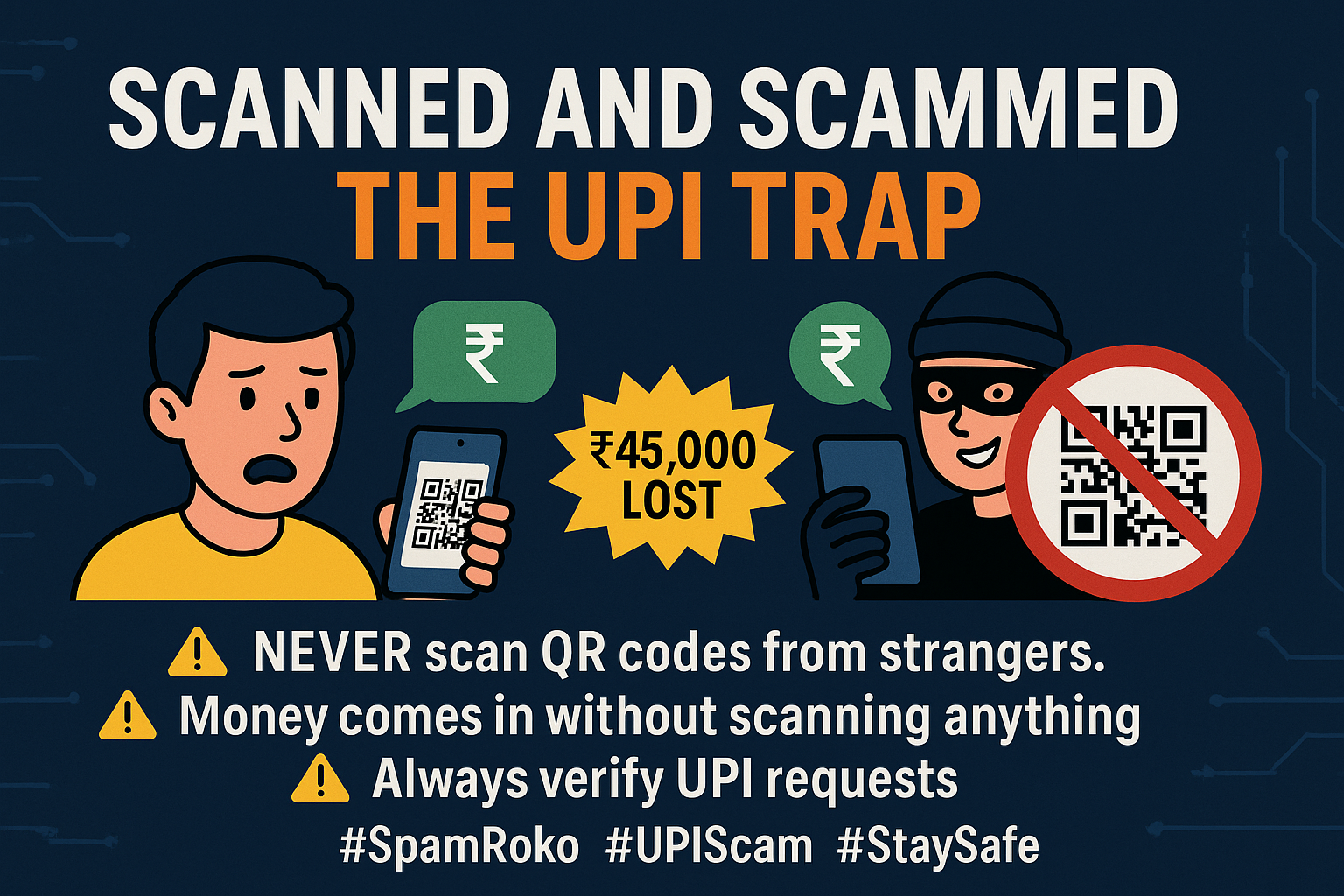

Don't Scan That Code! UPI Scam Alert 🚨

QR Code Fraud: The Hidden Danger in UPI Payments

💳 Understanding UPI QR Code Scams

In this scam, fraudsters send a QR code via WhatsApp, email, or even social media. They may say it’s for “sending you money” — but when the victim scans it, the code actually initiates a payment request instead.

Here’s how the scam typically works:

-

Fraudster Poses as Buyer

Someone shows interest in purchasing an item you posted online (on OLX, Facebook Marketplace, etc.). -

“I’ll Pay You Now” Trick

They send you a QR code and say, “Just scan this code and enter your UPI PIN to receive the money.” -

The Trap

You scan it, enter your PIN, and instead of receiving money — you unknowingly authorize a payment to the scammer. -

Funds Gone Instantly

Your account is debited in seconds. By the time you realize the mistake, the scammer has disappeared.

📷 Real Incident Example

A Delhi resident selling a used fridge online was contacted by a “buyer” who insisted on sending a token advance via UPI. The scammer shared a QR code and asked the seller to scan it and enter his UPI PIN. Within seconds, ₹25,000 was debited from his account. No fridge was ever collected, and the scammer’s number was unreachable.

🚩 Red Flags in UPI Scams

-

“Scan this QR to receive money”

-

“I’ll send you a token amount right now”

-

QR codes sent via WhatsApp from unknown numbers

-

Urgency: “I’m in a rush; just scan it fast”

-

Asking for your UPI PIN — never share it

🛡️ How to Stay Safe

✅ Never scan a QR code sent by a stranger, even if they claim to send you money.

✅ Do not enter your UPI PIN unless you’re making a known payment.

✅ Verify payment direction: Receiving money doesn’t require PIN entry.

✅ Use official apps only and ignore suspicious payment requests.

✅ Enable transaction alerts and daily debit limits on your bank account.

📞 What To Do If You’re a Victim

-

Immediately call your bank’s helpline and block further transactions.

-

Report the incident on https://cybercrime.gov.in.

-

File a FIR at your nearest police station.

-

Inform your bank in writing for reimbursement if eligible under RBI’s guidelines.

-

Share your experience on social media to prevent others from falling into the trap.

🔍 Final Advice

Scammers are using clever ways to exploit UPI’s convenience. Always remember — receiving money never requires scanning a code or entering a PIN. Stay alert, think twice, and educate others around you. A moment of doubt can save you from losing your hard-earned money.