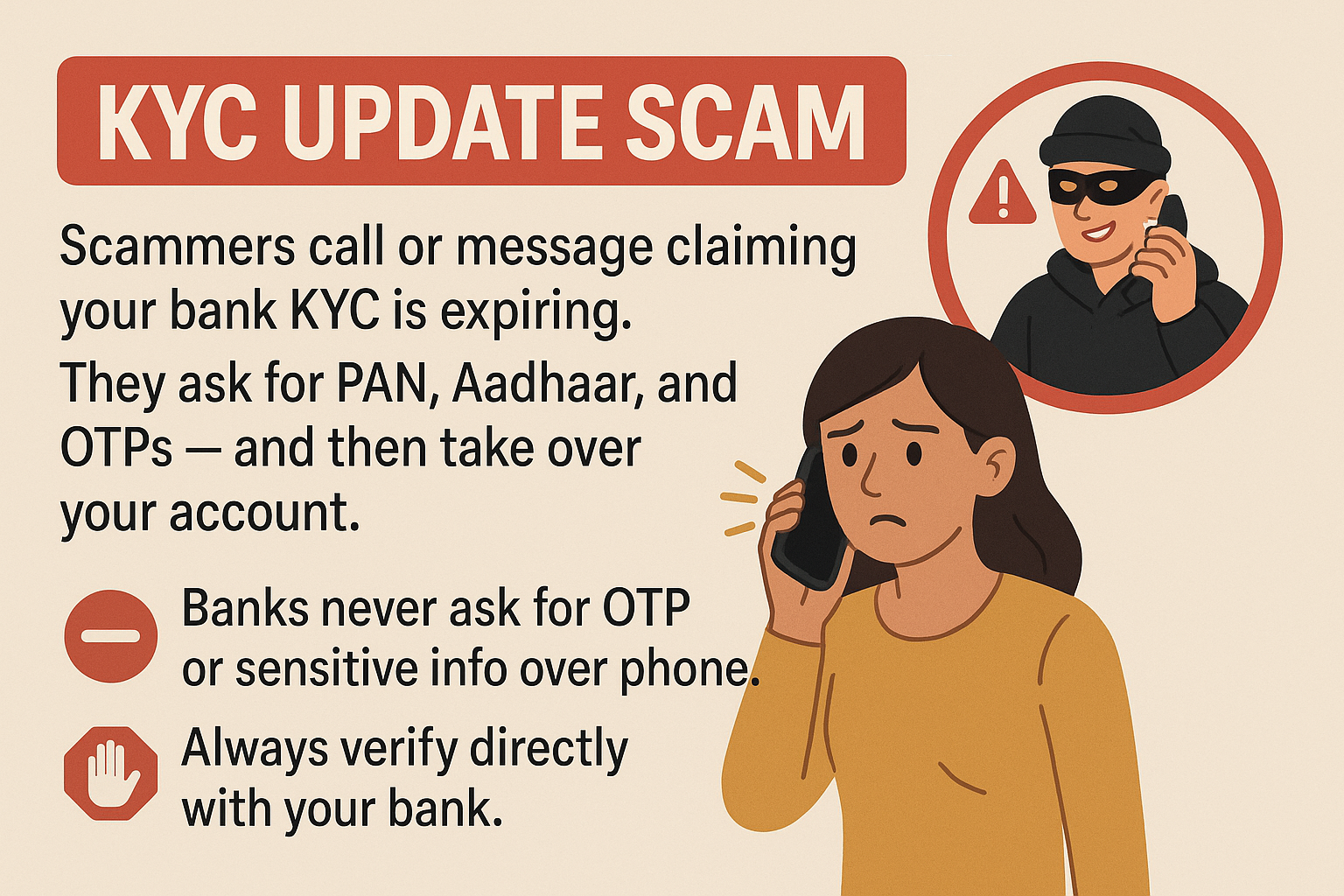

KYC UPDATE SCAM – DON’T SHARE YOUR OTP!

Fraudsters are impersonating bank officials to steal your identity and money in the name of "KYC update."

🚨 KYC UPDATE SCAM – DON’T SHARE YOUR OTP! 🚨

For example a man recently got a call saying:

"Sir, your bank KYC is expiring. If you don’t update it now, your account will be frozen!"

Panicked, he shared his Aadhaar number, PAN, and OTP...

Within minutes, his bank account was emptied.

These scammers sound professional and urgent — but it’s all fake.

🔒 How the KYC Scam Works: 🔹 You get a call/SMS warning of KYC expiry

🔹 They ask for sensitive info – PAN, Aadhaar, OTP

🔹 Once shared, your ac

❗ What Is the KYC Update Scam?

This scam is especially dangerous because it exploits people’s fear of bank service disruption. The scam flow usually looks like this:

-

You receive a message or call stating your KYC is expiring.

-

They may say "your account will be blocked" if you don’t comply.

-

The scammer asks for:

-

PAN card number

-

Aadhaar details

-

Bank account info

-

OTP received on your phone

-

-

If you share the OTP, the scammer gains full access to your bank account or UPI.

🔍 Real Case: KYC Scam in Action

In Mumbai, a 42-year-old man received a call saying his SBI account needed KYC verification. The scammer sent him a link and asked him to share an OTP. Within minutes, ₹72,000 was debited from his account. The bank confirmed that no such call was made by them.

🚨 Red Flags to Watch For

🚩 Calls or messages claiming your KYC is outdated

🚩 Pressure tactics: “Your account will be frozen today”

🚩 Requests for personal documents or banking info

🚩 Asking for OTPs or clicking on suspicious links

🚩 Messages from unofficial numbers or Gmail IDs posing as banks

✅ How to Protect Yourself

🔒 Banks never ask for OTPs or personal details via call, SMS, or WhatsApp

🔗 Always verify messages or calls via your official bank helpline or app

🛑 Never click on unknown KYC update links

📱 Use your bank’s official app or visit a branch for KYC updates

🧓 Educate family members, especially elders, about such scams

🆘 If You’ve Been Targeted

-

Don’t panic. Immediately disconnect the call or ignore the message.

-

Do not share any details or OTPs.

-

If you’ve shared something sensitive:

-

Call your bank and report fraud

-

Freeze your account or block your card

-

Change passwords and PINs immediately

-

-

Report to cybercrime.gov.in or visit your nearest police station

🔚 Final Word

Your bank will never call or message asking for OTPs or confidential KYC documents. When in doubt, always contact your bank directly using official numbers. Don’t let scammers turn a small message into a big financial loss.count is hijacked

✅ Stay Safe:

🔸 Banks NEVER ask for OTPs or full personal details over call

🔸 Don’t click on suspicious KYC update links

🔸 Call your bank directly if in doubt

📢 Share this with your friends and family. Let’s stop the fraudsters!

#KYCFraud #BankScam #StayAlert #SpamRoko #DigitalSafety #ScamAwareness